A good standard of housing is a basic need. Increasingly housing has become less affordable for a growing number of people in many locations worldwide.

This post focuses on the UK ( my home market). Affordable housing is however a global issue. As an illustration

A World Economic Forum report 10 ways cities are tackling the global affordable housing crisis | World Economic Forum (weforum.org) states

“…The unprecedented rate of urbanization across the world has led to increased demand for good, affordable housing. A recent survey revealed that of 200 cities polled around the globe, 90% were considered unaffordable when applying the widely-used standard of average house prices being more than three-times median income.

Affordability is not just about the ability to buy or rent a home, but also about being able to afford to live in it. ….”

Another global perspective ( on a country rather than regional basis) is shown in this link to the IMF Global Housing statistics IMF Global Housing Watch, and also in this report from the Demographia International Housing Affordability report , 2021 Edition Demographia International Housing Affordability — 2021 Edition – Urban Reform Institute

The impact of the pandemic is likely to have increased the problem of unaffordable housing with house prices and rentals increasing much faster than incomes in many (already unaffordable) locations

Can the interests of the various parties be aligned in a sustainable way?

I strongly believe that investing in affordable housing can , with the right structure, produce benefits to all the key stakeholders

- Local authorities in more affordable locations benefit from increased economic activity whilst meeting social objectives

- Individuals have more choice on where and how they live and work

- Financial institutions can , with appropriate credit support for mortgagees / tenants who have weaker credit scores, benefit from expanded financial services opportunities in the housing sector. There are, of course, existing ways in which financial institutions can support affordable housing ( such as providing finance to Social Housing organisations) but the market can be expanded further if there are appropriate credit protections.

- Developers and contractors can benefit from increased activity in the housing sector. With an expanded range of housing finance schemes , some development risks can be mitigated.

Is the problem a lack of space for housing or not maximising the utilisation of existing land and properties ?

Not just in the UK, but in many parts of the world attempts to increase the stock of affordable housing have focussed on “new builds”. In many cases what has been built has fallen short of targets , partly because developers feel that targets for affordable housing are not financially viable. At the same time there are many vacant properties including commercial properties that could be used, at least partly, for affordable housing. In areas where there are significant number of vacant properties there is already existing essential infrastructure.

“Data revealed following a Freedom of Information request made to UK local councils showed that there were 617,527 empty and unused buildings in the UK up to September 2019. Of these it was estimated that 172,217 of these were commercial premises….” Comprehensive Guide To Empty Property Security – Farsight

As referred to in that article, there are security and social issues that are a consequence of vacant properties. There are also ongoing maintenance costs.

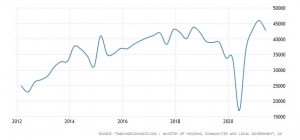

To put the number of vacant properties in context below is a chart showing UK quarterly housing starts. In the period illustrated housing starts in any year have been below the estimates referred to above of vacant commercial property alone

Can more affordable housing be created in the UK through encouragement / incentivisation for people to move areas?

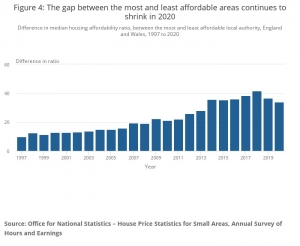

As would be expected there are significant major disparities in affordability by region. In the case of the UK this is illustrated in the statistics from the Office for National Statistics on house purchase and rental affordability. The chart below which relates to house purchase shows that , although there has been some decline in “affordability gaps” the gap between regions is very high. The impact of the pandemic will, based on recent reports of home prices, however increase the lack of affordability in many parts of England and Wales.

Affordability is also a problem for people trying to rent housing in England

This Table shows the highest rent quartile that a household at each income quartile can rent for less than 30% of income, by region, FYE 2020

| Region | Lower Income | Median Income | Higher income |

| East Midlands | Low rent | High rent | High rent |

| North West | Low rent | High rent | High rent |

| Yorkshire and The Humber | none | High rent | High rent |

| West Midlands | none | High rent | High rent |

| North East | none | Median rent | High rent |

| East of England | none | Median rent | High rent |

| South West | none | Median rent | High rent |

| South East | none | Median rent | High rent |

| London | none | none | High rent |

Source: Office for National Statistics – Family Resources Survey, Private rental market statistics

Encouraging / incentivising people to move from their existing location can make a difference to the supply of affordable housing. Laws of supply and demand will of course mean that prices will rise in areas of higher demand but if the objective is to make housing more affordable some decrease in affordability in some areas will still help to improve the overall level of affordability.

Is this time different from the past in terms of increasing the supply of affordable housing?

We are at a point in time when a combination of factors can facilitate the supply of affordable housing. Principal amongst these are

- Impact of technology and broadband. There is less need for many people to travel to work on a daily basis

- Work from home. The pandemic has clearly illustrated that working from home, at least on a part time basis, is viable for many people

- The COVID pandemic is causing many people to re – assess their housing priorities. In particular more people want outside space.

- Better building methods which can reduce costs of construction and running costs (such as better energy efficiency)

- Better design can maximise the use of available space

- Greater availability of vacant / underutilised commercial space, particularly retail properties, as there are changes in how people work and shop

What are some of the barriers to increasing the supply of Affordable Housing?

- Planning: this barrier could be reduced by

- introducing legislation that incentivises owners of longer term vacant properties to make the properties available for affordable housing

- Reducing barriers to change of use to affordable housing

- Employment opportunities in a location: this barrier should become less of a problem as “remote working” becomes more feasible and also more acceptable to employers

- People not wishing to move areas: There are of course factors like being close to family and friends that are a major influence on people’s decisions whether to move. With improved transport infrastructure this can be partly mitigated

- Financing: Especially with affordable housing there has to be recognition that some occupiers may be in a vulnerable position in terms of their physical, mental and financial health. This will require the private sector to work closely with the public sector to ensure a balance between the need to protect vulnerable people and acceptable levels of financial risk for providers of capital

What can be done?

This link below outlines what has been done in several locations, globally, to improve the supply of affordable housing.

The following are some of my own thoughts. As mentioned above this article focuses on the UK, but the general principles will be applicable to a greater or lesser extent elsewhere

- Relocation packages – help from local government with schools, fast and reliable internet, employment can reduce the cost and stress of moving

- Upgrade of existing infrastructure by local authorities. In many areas the essential utility and social infrastructure will already be in place

- Faster planning decisions

- Incentives to bring back vacant properties into use. This could be in the form of grants or loans to property owners and use of compulsory purchase orders

- Employment incentives: assistance with training and grants to employers in “more affordable” locations

- Relocation of public sector jobs to “more affordable” locations

- Credit support to purchasers / renters from local authorities in areas with higher levels of affordability to people relocating to the relevant area. The terms of any support should be a function of the level of affordability in the area, and should be for a limited period and also be subject to review based on an individual’s income

- Increased encouragement for the development of Affordable Housing Real Estate Investment Trusts: If credit support from local / Central Government is provided there is scope for the development of Affordable Housing REIT with a range of risk profiles

The level of any support can be based on an independently verified affordability index and should be evaluated annually based on an individual’s own affordability profile.

What not to do

- Help to buy schemes which provide support for low deposit mortgages should not be encouraged as they tend to push up prices. Direct , non mortgage related, support to people buying / renting properties who cannot meet traditional mortgage criteria or rental conditions is a better option for affordable housing

Particularly if you are involved in the provision of Affordable Housing and /or its financing I’d very much welcome your comments

I don’t make New Year’s resolutions but for 2022 I hope that it will be a year when major progress is made in increasing the supply of affordable housing on a sustainable basis.

As you will infer from this post, I believe the current disruptive environment means that a combination of factors, and with commitment from government ( central and local) , developers and financiers there is a favourable environment for improving the amount of affordable housing. I am not underestimating the challenges, but I believe that with a change in mindset the current disruptive environment is creating a positive environment to improve housing affordability.

I’d therefore welcome any practical suggestions on how you believe housing affordability can be improved that will balance the needs of house owners, government , financial institutions and housing developers and contractors, and to comments highlighting barriers that need to be overcome.

Leave A Comment