Commodity prices are a key indicator of economic activity. The steep fall in commodity prices, particularly since mid 2014, is widely reported. What however are the implications for the Residential Real Estate markets?

Will the downturn in oil prices have the reverse effects of the oil price increases in 1973/74 and 1979/80 or are residential Real Estate prices already overoptimistic?

You will form your own views but the following are some key factors to consider:

The period from about 1999 to the outset of the credit crisis in 2007 was exceptionally benign for the Real Estate markets

- China, India and many markets in Central and Eastern Europe were opening up their economies. This represented an exceptional boost to demand as those and other major Developing Economies transitioned to “market economies”

- Real interest rates in mature economies were low

- Leverage in the government, financial and personal sector was rapidly increasing

- Political tensions resulted in (unfortunately in human terms) increased demand for goods and services

The political and regulatory response to the onset of the credit crisis in 2007, as well as weak economic performance in many mature markets, has yet to deal with some of the underlying problems in Residential Real Estate prices in a number of major cities

- Record low levels of interest rates in many mature economies, combined with quantitative easing, has

- underpinned asset values

- partially offset the negative effect of tighter regulation of financial institutions

- resulted in financial investors focussing on “lower risk investments” which in turn has further reduced yields on “safer investments” which may have resulted in some overvaluation of Real Estate investments

- Government support in some countries for house buying has supported asset values

- Underlying macroeconomic growth in mature economies continues to be weak, making it difficult for governments to reduce deficits and debt

- Uncertainty and weak economic performance has resulted in “hoarding of cash” by many corporates rather than investing surplus capital

Consequence: as a generalisation in every asset class the uncertain business environment is causing investors to focus on perceived” higher quality” investment opportunities. The higher yields on many Real Estate investments relative to bond and equities, even though they have been compressed, may seem attractive. However there are questions as to whether an “asset bubble” is developing in some residential real estate markets.

What are the consequences of the economic environment for the average individual property owner?

- A fundamental need of any individual is somewhere to live

- There is a global oversupply of labour as a result of globalisation and technology

- Individuals will move to where there are work opportunities to cover their financial needs

- Housing availability in areas of high demand is insufficient, forcing both rents and sales values higher. In some areas not only are lack of work opportunities driving accommodation decisions but also political stability/instability

- The end of the “commodity super cycle” , will assist consumers with “day to day” inflation of basic goods and services

- Although unemployment statistics in some markets show good job creation, this partly reflects self employment / part time employment which is currently unlikely to push up wage inflation to a significant degree across an entire economy.

- At some stage relatively high housing costs and the ability to use technology in work may cause people to move locations but this could be over many years

Implications for investing in Residential Real Estate?

- Over a longer time frame technology may make a difference in where people are able to work, but even then people will want to be in areas with a well established infrastructure. In this scenario there is likely to be an underpinning of housing prices in desirable locations

- Compared to previous market downturns regulatory pressure on banks is resulting in more stringent mortgage affordability tests. Therefore the effect of an economic downturn may be less severe

- As with any economic situation prices are determined by actual and perceived supply and demand factors. In a downturn the locations that have witnessed the most speculative activity ( leveraged investments/ overbuilding) or weakening economic fundamentals are likely to be most adversely affected

- Economies that are highly dependent on commodity prices and /or which have falling growth rates are most at risk in terms of a downturn in residential real estate prices

What are some market indicators suggesting?

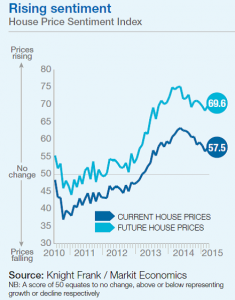

Indicators vary from market to market but some indicators are suggesting a still positive, but weakening growth, including

UK indicators

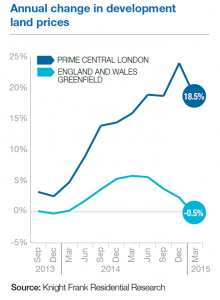

- Land prices: In the report produced by Knight Frank & Rutley “Housebuilding Report 2015” an indication of a positive but weakening outlook is shown below, based on a survey of UK housebuilders

- The Development Land price will of course reflect future sales prices expectations, where the outlook in the survey whilst still positive is deteriorating as shown below.

To some extent the positive outlook for prices but weakening trends in development land prices is likely to be factoring in higher construction and labour prices.

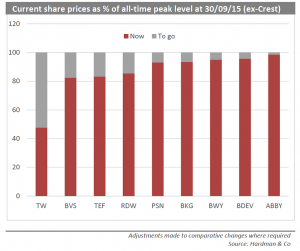

Share prices of housebuilders

- Since the onset of the credit crisis the share price performance of major UK housebuilders has been very strong: The example below of Barratt Developments, one of the UK’s largest housebuilders, illustrates the point.

- Share prices in many cases are close to all time highs

- and the sector’s gearing levels are low…in a number of cases negative

- Relative to other sectors in the UK market the performance of the major UK housebuilders from Q3 2014 – Q3 2015 has been exceptionally strong. Some market commentators however expect downward pressure on major UK housebuilders’ share prices given the recent exceptionally strong performance.

USA

In the US current market sentiment, as illustrated in the NAHB/ Wells Fargo Housing Market Index (http://www.nahb.org/en/research/housing-economics/housing-indexes/housing-market-index.aspx) continues to be positive

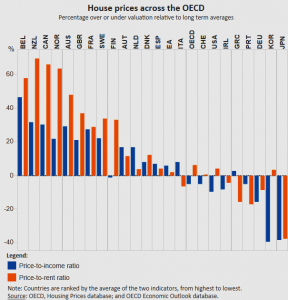

OECD house price statistics

As shown in the graph below residential Real Estate in many markets is above the long term average (data as of mid 2015)

Stockmarket indicators

In 2015 performance of many key stockmarket indices (S&P500, FTSE100,FTSE Eurofirst 300) was weak, therefore reflecting perceptions about weak economic growth

Will any downturn in residential real estate prices in the current real estate cycle will be different from previous cycles?

Positives: In the short term, in the event of a market downturn, there are some positive factors that might mitigate downturns in Residential Real Estate Markets, including:

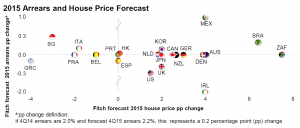

- Banks have been deleveraging and regulators more stringent post the credit crisis: Although the data below ( Source: Fitch Ratings Global Housing and Mortgage Outlook 2015, January 2015) is based on a period of (slow) recovery it illustrates a positive position…although in my opinion the impact of the commodity price downturn is likely to be significantly be more severe and accelerate in Developing Economies that have significant exposures to commodity prices, should commodity prices not substantially increase

- Tougher mortgage availability criteria: The catalyst for the subprime crisis in the US was the increased availability of mortgages for borrowers with weaker credit quality. Mortgage availability is generally now more restrictive

- Demographic shifts boosting demand in some locations: migration to locations with stronger economic prospects may support housing prices for longer where there is still shortage of housing, taking into account future planned supply

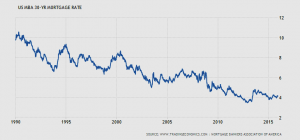

- Lower interest rates since the credit crisis and greater availability of fixed rate mortgages for creditworthy borrowers

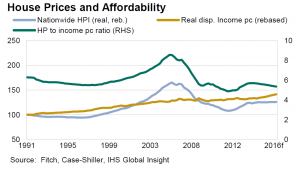

This is illustrated by the table below

Improved mortgage affordability in the USA:The impact of lower interest rates combined with other factors has translated into improved affordability in US markets as shown in the table below(Source: Fitch Ratings, Global Housing and Mortgage Outlook January 2015)

Mortgage affordability in the UK: Using the UK as an additional example, mortgage affordability, based on the Halifax (part of Lloyds Banking Group) Index of mortgage affordability as a % age of income, is relatively good in many parts of the UK relative to the average since 1983. Greater London is the only area where mortgage affordability is lower than the average. This is shown below

| North | Y&H | NWest | Emids | Wmids | Eanglia | Swest | |||||||||

| 2015 Q1 | 22.2 | 23.0 | 23.7 | 25.7 | 28.2 | 25.3 | 33.0 | ||||||||

| 2015 Q2 | 22.2 | 23.5 | 23.7 | 26.1 | 28.2 | 27.5 | 32.7 | ||||||||

| 2015 Q3 | 22.3 | 23.3 | 23.2 | 26.5 | 28.0 | 28.0 | 32.4 | ||||||||

| MAX | 53.0 | 54.9 | 57.0 | 65.3 | 70.1 | 81.3 | 86.1 | ||||||||

| MIN | 20.3 | 20.5 | 20.7 | 21.7 | 24.8 | 21.8 | 25.3 | ||||||||

| AVG | 29.4 | 28.5 | 29.6 | 33.0 | 36.2 | 35.3 | 41.9 | ||||||||

| Seast | Glondon | Wales | Scotland | Nireland | UK | ||||||||||

| 2015 Q1 | 36.4 | 43.4 | 26.0 | 19.8 | 18.0 | 28.4 | |||||||||

| 2015 Q2 | 37.1 | 45.0 | 25.3 | 21.1 | 19.5 | 28.8 | |||||||||

| 2015 Q3 | 37.4 | 45.7 | 25.5 | 20.6 | 20.1 | 29.0 | |||||||||

| MAX | 99.8 | 81.7 | 58.6 | 50.9 | 64.1 | 65.5 | |||||||||

| MIN | 28.8 | 24.1 | 21.3 | 19.2 | 17.1 | 23.6 | |||||||||

| AVG | 47.0 | 43.3 | 32.0 | 28.9 | 29.0 | 35.6 | |||||||||

- In some of the “hotter” residential real estate markets a significant amount of purchases will have been equity funded or with relatively low leverage

Some negatives

- Housing affordability is under pressure in a market like the UK as shown in the following data for the House Price to Earnings ratio( covering the period from 1983) based on the Halifax (part of Lloyds Banking Group) Index.

| North | Y & H | NWest | EMids | WMids | EAng | SWest | |

| 15Q2 | 4.18 | 4.47 | 4.43 | 4.87 | 5.26 | 4.92 | 6.06 |

| 15Q3 | 4.21 | 4.44 | 4.35 | 4.96 | 5.23 | 5.02 | 6.02 |

| MAX | 5.92 | 5.13 | 5.06 | 5.37 | 6.15 | 6.87 | 6.95 |

| MIN | 2.56 | 2.45 | 2.59 | 2.94 | 3.18 | 3.14 | 3.31 |

| AVG | 3.62 | 3.47 | 3.54 | 3.95 | 4.32 | 4.20 | 4.96 |

| SEast | GLond | Wales | Scot | N Ireland | UK | ||

| 15Q2 | 6.48 | 7.82 | 4.82 | 3.94 | 3.83 | 5.26 | |

| 15Q3 | 6.53 | 7.96 | 4.87 | 3.85 | 3.96 | 5.31 | |

| MAX | 7.54 | 7.96 | 6.10 | 4.83 | 8.59 | 5.86 | |

| MIN | 3.73 | 2.93 | 2.84 | 2.60 | 2.78 | 3.09 | |

| AVG | 5.26 | 4.78 | 3.94 | 3.53 | 4.27 | 4.15 |

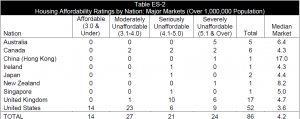

- More major metropolitan areas are becoming unaffordable

Whilst the UK may be a relatively extreme case, a broader view of “housing affordability” is shown in the Table below (Source: Demographia International Housing Affordability Study, 2015 based on figures for Q3 2014 for major metropolitan areas).

- Developing Economies

Although care is always needed when making generalisations some major markets in China and India and Brazil are considered to be oversupplied, so downward price corrections are likely. The extent of any downturn will be influenced by government action to support markets as well as the levels of real estate related leverage.

In some Developing Economies that are experiencing weaker economic conditions there has also been a significant growth in real estate related debt which may result in substantial downward pressure on residential real estate prices

Overall view – as a generalisation expect downward pressure on residential real estate prices

As in any economic scenario there can be sudden changes. Political stability and security threats are a concern. These could be a catalyst for volatility in the financial markets and subsequently the general economic environment.

Commodity price declines particularly since the Summer of 2014 should however be viewed as a positive factor in terms of mortgage affordability and therefore limiting the likelihood of a severe “commodity price shock” in mature economies.

Absent sudden unexpected changes there are however signs of a weakening market in residential prices with some consequences being that

In mature economies

- Given rapid increases in housing prices in some major cities a correction in prices can be considered likely

- Increased Real Estate taxes in the UK are likely to have a particular affect on “high value properties” and “buy to let” investments, but this should not have a systemic affect as it is likely that such properties are much more modestly leveraged than “typical owner occupier” mortgages. In markets like London there is however likely to be a “trickle down effect” from any downturn in “luxury properties”

- The downturn in commodity prices will have most impact in those markets that are heavily influenced by commodity prices. The affect may not yet be apparent as it takes time for the effect to be reflected in residential market activity

- Decreased housing affordability in some markets is not likely to be met by banks reducing credit standards

- Reduced housing and mortgage availability/ affordability , where it exists, does not mean that the housing demand will reduce…it will probably stimulate “build to rent”, more government support, and shared ownership schemes

- Low interest rates have been supporting house prices and in some mature markets like the UK the price to income levels are high and therefore very sensitive to adverse economic conditions

In Developing Economies

- As in mature economies the downturn in commodity prices will have most impact in those markets that are heavily influenced by commodity prices

- In some markets like China the weaker commodity prices reflect weaker economic fundamentals which will affect residential real estate prices. In recent years the level of real estate related debt in China has been growing, thus increasing the risk of a substantial correction in residential real estate prices in oversupplied markets.

- The 1997 downturn in Asian markets illustrates that even when there has been a period of strong economic growth that a crisis in a market can quickly develop if there is a substantial amount of real estate related leverage

Leave A Comment