The question

The post credit crisis period has witnessed a profound change in energy markets. Are lower energy prices since mid 2014 positive for the power generating sector, what can we learn from past experience, and what are the implications for the financing of power generation companies?

Past challenges

The Power generating industry has faced many challenges such as

- Oil price hikes in 1973

- Further energy price increases in 1979 / 1980

- Deregulation and privatisation

- The Asian crisis

- Renegotiation of Power Purchase contracts in several Emerging Economies

- Collapse of Enron and restructuring of other power companies

- Growth of the renewable energy business

- Boom and collapse in energy and other commodity prices in the current Millennium. To put this in the context of a current WTI price in the region of US$45/barrel, oil prices have been almost as low as US$10 and in slightly in excess of US$150 / barrel in the current Millennium

- Impact of shale gas on supply

- Revisiting incentives for the renewable energy industry

The current scenario

The current ( September 2015) scenario of increasing supply of oil and gas, enhanced technology ( both in renewables and also technology like enhanced Carbon Capture Systems), ongoing effects of the Credit Crisis on the availability and cost of financing and sharp reductions in energy prices since mid 2014 is creating huge challenges for companies in the natural resource sector.

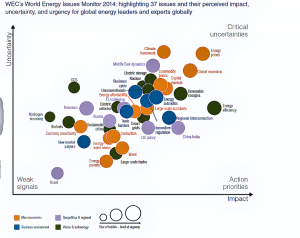

In terms of the energy markets overall in the World Energy Council 2014 World Energy Issues Monitor, the following were identified as key issues globally

Used by permission of the World Energy Council, London www.worldenergy.com

Issues for the power generating sector? What can we learn from the past?

As with many economic issues answers do not conveniently fit into a box. Moreover the power generating sector has been evolving as a result of economic development and deregulation so there is limited past experience in the power generation sector to compare with the current market conditions.

More generally history has however shown that deregulation creates business challenges (for example the telecoms, airline and banking sectors) and that companies which have highly leveraged capital structures on the basis of a monopolistic or oligopolistic business sector are obviously exposed to high financial risk if sector changes are unfavourable.

There are a range of scenarios. However the current business environment presents a combination of challenges for the power generation sector that make the future more than usually uncertain, with some key influencing factors being:-

Economic environment

The affects of the “credit crisis” are still apparent. The banking sector is still adjusting to a more stringent regulatory environment and economic growth in the US and other key economic areas has generally been weaker than many economic forecasts.

Government finances and country and political risk

Weak economic growth combined with high debt levels in the US and other major economies presents constraints on the ability of governments to stimulate economic activity.

Countries that have had a high dependence on natural resources face challenges in meeting budgets and raising long term capital, which in turn will have an impact on the Power Sector.

Changing energy mix and macroeconomic and political considerations – Cheap fossil fuels vs more expensive clean energy

Whilst there is a clear desire to increase renewable power, government financial constraints and weak economic conditions are producing a conflict between increased use of environmentally friendly energy and the cost of subsidies.

In terms of potential sources of power generation the role of nuclear energy is uncertain.

In some markets renewable energy sources are being given priority in dispatch but particularly in markets with weak economic conditions and stretched finances relative cost of technologies will be a major consideration in sources of energy for power.

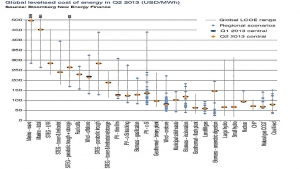

As is shown below a fossil fuel such as coal continues to be a low cost option purely on financial terms.

Source: World Energy Council, World Energy Perspective, Cost of Energy Technologies; Project Partner Bloomberg New Energy Finance. Used by permission of the World Energy Council, London www.worldenergy.com

Supply and demand of fuel

There will be regional differences but overall the high energy prices until mid 2014 has resulted in growth of new supplies with obvious downward pressures on fuel prices. This may reduce political pressure on utilities if the full effect of lower fuel costs is passed on to customers, especially in the retail sector.

Cost of transmission and deregulation

In markets like the US building more transmission lines is likely to increase transmission and distribution costs for power companies

Technology

Technology is having an impact at several levels such as

- Lower unit costs for some renewable power sources as they achieve economies of scale;

- Energy efficiency both in retail and industrial uses and in sectors like the car industry;

- Carbon Emission technologies such as carbon capture systems are reducing the net carbon output from carbon based power plants

What are the implications for financing of power companies and power projects?

As mentioned above there are a combination of uncertainties facing power generating companies but, in the event of continued “below trend” growth in economic activity some of the consequences for power generating companies can be summarised as:

1. Growth in Merger and Acquisition activity as companies will increase their focus on cost management if demand for power is weak and there are pressures on profit margins;

2. Changes in business models in the power sector. For example demerger of / spin offs of businesses in vertically integrated power companies;

Asset intensive companies, such as power generators, may move to a more “asset lite” and trading business model in order to enhance shareholder returns;

3. Debt providers and equity investors are likely to continue to focus on companies with strong and predictable cash flows in countries with strong credit ratings;

4. Companies are likely to need more equity in their funding mix, especially those companies that have been downgraded to or have chosen a capital structure that is sub or low investment grade;

5. Development Finance Institutions and Export Credit Agencies will continue to be important in the funding structure of power projects.

Some interesting articles / papers if you are interested in further assessing the topic

BP Energy Outlook 2035 – www.bp.com/energyoutlook

Deloitte Center for Energy Solutions, 2015 Outlook on Power and Utilities My Take: By John McCue – http://www2.deloitte.com/us/en/pages/energy-and-resources/articles/2015-power-and-utilities-industry-outlook.html#

US Energy Information Administration, Annual Energy Outlook 2015 – http://www.eia.gov/forecasts/aeo/

PWC, Power & Renewables Deals 2015 outlook and 2014 review – http://www.pwc.com/gx/en/utilities/publications/power-and-renewables-deals-2015-outlook-and-2014-review.jhtml

World Energy Council, World Energy Perspective, Cost of Energy Technologies, Project Partner: Bloomberg New Energy Finance – http://www.worldenergy.org/wp-content/uploads/2013/09/WEC_J1143_CostofTECHNOLOGIES_021013_WEB_Final.pdf

World Energy Council 2014 World Energy Issues Monitor – http://www.worldenergy.org/wp-content/uploads/2014/01/World-Energy-Issues-Monitor-2014.pdf

Leave A Comment