As we all continue to hope that the adverse impact of COVID-19 on people’s physical health becomes sufficiently manageable that it is safe to continue to reduce the restrictions on our daily activities, governments will need to develop sustainable solutions on an ongoing basis to stimulate economic activity.

PPP will be one of the tools that can be used. We can only speculate about how and to what extent PPP can be part of the solution to rebuild economies, but there are a number of issues that will have to be considered

- Government support following the onset of COVID – 19 has been massive, placing strains on government finance. Governments will need to be more cost conscious and pay more attention to obtaining Value for Money and measuring the potential impact of PPP.

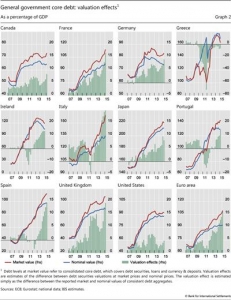

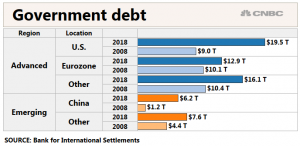

The cost of support to limit the economic damage as a result of the Global Financial Crisis and COVID-19 has been huge. This is illustrated in the graphics below showing the rise in Government Debt

Source for Government debt figures above: Bank for International Settlements

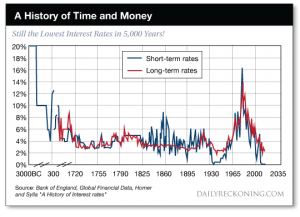

2.Interest rates are at historically low levels – cutting interest rates to stimulate economic activity is far more restricted now than was the case following the Global Financial Crisis.

The development of interest rates historically is shown below ( not sure about the reliability of any sources for interest rates before about 1700!)

Source: https://dailyreckoning.com/5000-years-of-interest-rates/

3.Large infrastructure projects often result in huge cost overruns – more focus needed on smaller scale projects and urban regeneration?

There are a number of very interesting and insightful articles written by Professor Bent Flyvberg on the subject of cost overruns and large infrastructure projects.

At a time of strained government finances, large projects may need to be scrapped, or at least deferred and definitely should be re- evaluated.

The impact of COVID-19 and disruption in some sectors is likely to have a particularly negative affect on some communities leading to a need for local urban regeneration projects.

4. Governments need to be more rigorous in assessing Value for Money

Strained government finances mean that there needs to be increased attention to measuring costs and benefits. Quantitative methodologies to assess the viability of PPP projects will need further standardisation and independent evaluation free of political influence.

5. Risk and return allocation on projects needs to be re – examined

Traditional PPP financings have, in a number of cases, resulted in either excessive returns for the Private Sector investors or termination of Concessions. Neither are desirable. COVID- 19 has clearly presented , and will present, challenges for both investors and users, both during construction and when operational. Competitive bidding for projects is of course desirable, but it can produce a “win – lose” outcome. Sharing of returns above minimum thresholds with the public sector in return for additional protection to investors would result in a better alignment of interests of key stakeholders.

6.Financing structures will need to be re- evaluated

COVID-19 will result in a re- evaluation of risk in a number of sectors where PPP is used, such as transportation. Some of the consequences for the financing of PPP transactions might be

- Lower levels of leverage

- Need for additional credit support to improve access to and terms of finance. Especially in weaker countries credit pricing is likely to increase and therefore impact the cost of services to Public Sector users of PPP projects

- Financing pools of PPP projects, with project substitution options, rather than single purpose Project Finance transactions. This can provide additional flexibility for the public sector and provide a financing vehicle (private or publicly quoted) that can support smaller scale projects

7.Increased emphasis on “social” issues in evaluating potential PPP

Environmental issues have already been an important consideration. COVID-19 can be expected to lead to increased emphasis on social impact issues, such as employment generation and urban regeneration.

Conclusions

As at any time of change there will be risks and opportunities. Governments around the world are now facing strains on their finances making it increasingly essential that PPP transactions are structured to align the interests of all key stakeholders, meet environmental and social objectives, and with extra scrutiny of measuring costs and benefits of any PPP.

As always, I would very much welcome your comments.

Leave A Comment