Housing affordability has been a growing problem for an increasing number of people in recent years

At a time when technology is disrupting many industries leading to declining prices for a wide range of consumer goods and services, housing has become increasingly unaffordable for a growing number of people. Improving affordability should be a major priority for governments.

Although this post focuses on the UK, housing affordability, both for rent and sale, has been an increasing problem in many locations globally. This link to IMF data shows recent house price data IMF Global Housing Watch

Is house price affordability in the UK low by historic standards?

Very interesting article on house price affordability in the UK from # Schroders accessible via this link. What does centuries of UK housing data tell us? – Schroders global – Schroders

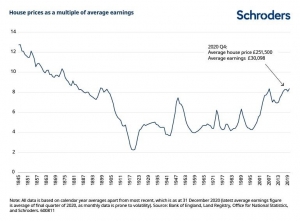

The graph at the top of this article from the #Schroders article illustrates the historical affordability of UK housing in terms of the multiple of house prices in relation to average earnings.

As with all data it is inappropriate to draw general conclusions but for me the key drivers referred to in the article that led to a multi decade reduction in the ratio of house prices to earnings starting in the second half of the 19th century are not likely to be repeated in the current environment, specifically

- More houses: unlikely to a significant extent in areas that already have high population densities and strong resistance from residents to build on “green belt” sites

- Smaller houses: the trend towards smaller house sizes has been in place for many decades. If anything, there is a shortage of family homes rather than miniscule “starter homes”

- Rising incomes: at least in the short term it is difficult to imagine real increases in incomes across the whole of the UK working population

What might change the situation?

If my observations are accurate , at least the short term outlook for affordable housing is not encouraging. What might change the situation is a combination of

- If there are significant decreases in population following Brexit

- Significant increases in interest rates which depress house prices as a result

- Major relaxation in planning rules

- Potential impact of working from home. This might have the impact of reducing relative prices as how people work, shop and live change

- Government stimulus to the affordable housing sector. In my opinion this has to be something other than “help to buy” which, more likely than not, has served to boost housing prices . Any future schemes need to be more tailored to the needs of people who are currently unable to raise mortgage finance

- Developing financing schemes which balance the needs of providers of capital, house builders, the social housing sector and tenants. This might involve setting up specific housing funds where long term tenants are given / can purchase equity stakes based on the length of their tenancies and meeting their obligations as tenants

As will be seen from the graph lack of unaffordability is not at an “all time high” . However, inspite of the increasing unaffordability of UK housing for sale / rent, trends in housing prices based on the past suggest that a significant increase in affordability will not occur quickly absent major changes in government policy, new approaches to the financing of affordable housing, and a sustained rise in interest rates.

As always I very much welcome comments and suggestions on how to tackle the problem of affordability of housing.

Leave A Comment