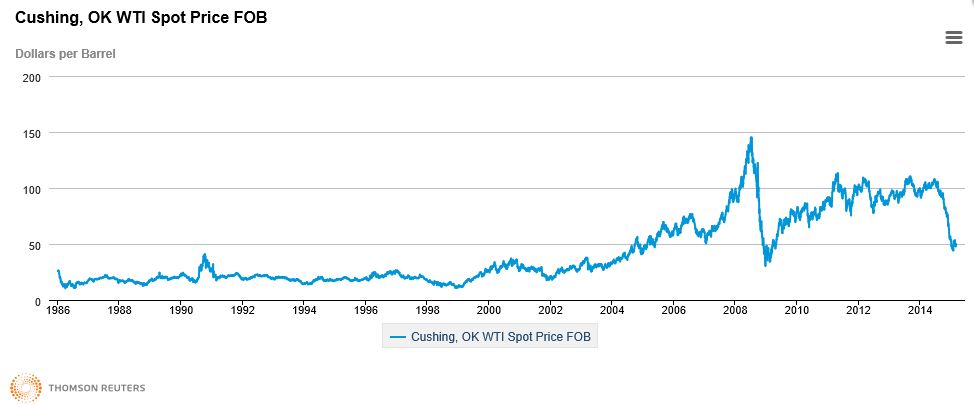

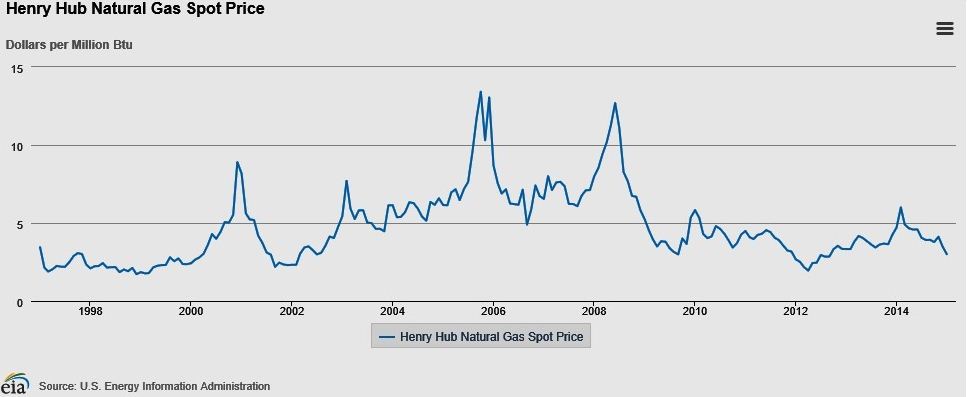

Not with standing the substantial fall in oil and gas prices during 2014, there is still uncertainty about the future trends in prices.

The post 2002 increases until the downturns in the financial markets in 2007/8 and the rebound in oil prices from 2009 – 2014 may be a reflection of general growth in the World Economy post the 2000 – 2002 economic downturn and in particular the impact of growth in markets China and India, as well as the impact of moves to stabilise financial markets following the onset of the credit crisis. These are factors that might be considered as exceptional. Current prices or lower could therefore be the “new norm” or reversion to long term trends if there is slow / slowing economic growth.

Moreover the high prices until the downturn in 2014 resulted in more projects coming on stream, some of which may no longer be viable, including increased production of energy from shale gas. Although supply and demand factors will have global consequences, the supply / demand equation in specific markets also has an impact on relative pricing between geographic markets.

The current environment

Source: Energy Information Administration

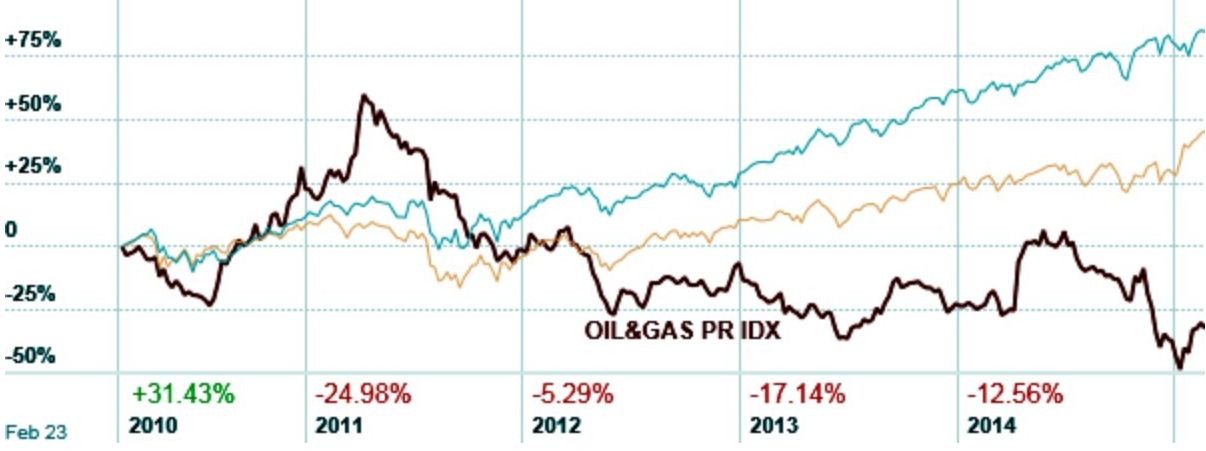

The “headlines” are about the oil and gas prices but all companies in the oil and gas value chain will be impacted

Each sector has its own specific features but history shows that a change in business fundamentals in an industry typically affect companies throughout the entire value chain. In the telecom crisis in the early years of the Millennium, equipment suppliers to the telecom operators found that their order backlog declined very sharply. Any cut backs in exploration and development will impact suppliers.

Corporate Finance vs Project Finance and capital structuring decisions

Given the declines in oil and gas prices companies in the oil and gas sector will need to re- evaluate their financing decisions and capital structures. Each company has its own characteristics, but even assuming an increase in oil and gas prices, companies in the sector will need to pay careful attention to the availability of finance, both debt and equity. Companies with high leverage and significant short term refinancing needs are particularly vulnerable to market sentiment. Contractual commitments and derivative contracts entered into before the recent downturn in oil and gas prices may also result in ongoing pressures on cash flows, asset write downs and liquidity.

Raising corporate equity

Re- leveraging to introduce more equity in the capital structure may be the desired choice for some companies, but as the table below shows the oil and gas sector has substantially underperformed in recent years both in absolute terms and relative to market indices such as the S&P 500 (blue line below)) and the Eurofirst 300 over the 5 year period to February 23, 2015

Source: http://markets.ft.com/research/Markets/Tearsheets/Summary?s=AS00530:FSI

Raising Debt

Debt financing terms will also be more stringent and it is likely that companies with significant exposure to political, development and market risks will find access to funding restricted and more expensive, especially companies that are highly leveraged with significant short term refinancing needs and adverse interest and currency exposures.

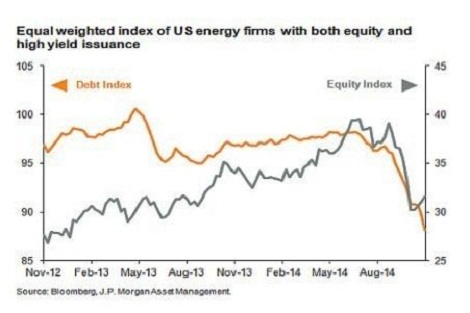

High energy prices before the market downturn have, as known, encouraged development of new energy sources. Some of the recently started projects will be under pressure at current market prices. An article in the Daily Telegraph on 14th November 2014 highlighted the impact of falling energy prices which made reference to a report which stated

“….Based on recent stress tests of subprime borrowers in the energy sector in the US produced by Deutsche Bank, should the price of US crude fall by a further 20pc to $60 per barrel, it could result in up to a 30pc default rate among B and CCC rated high-yield US borrowers in the industry…..”As is known as at the end of February 2015 the WTI spot price has fallen significantly since the article was written in November 2014.

In the same article the position of US high yield issuers is illustrated in the following graph

Uncertainty in the financial markets is certain, so what are some of the key questions in considering oil and gas Project Finance and recent experience?

Is Project Finance available?

The Energy markets face major challenges. The financial markets, whilst stabilising following the onset of the credit crisis, are still cautious with weaker credits. Against this background Project and infrastructure finance is however likely to be available for effectively structured oil and gas projects, with limited Country and political risks, strong sponsors and stakeholders and robust financial metrics with relatively stable cash flows supported by solid contractual arrangements.

Although energy prices have been under pressure data from Dealogic shows that North American Oil & Gas Project Finance volumes were at record levels. Globally, 156 deals reached financial close in the Oil & Gas sector in 2014 for a total of $112.8bn. This was up 7% from $105.4bn closing in 2013 via 165 deals, and the highest annual volume on record.

Transactions closed in 2014 would however have been initiated before the recent downturns in energy prices and some transactions like the Cameron Shale project in the US are reportedly structured to mitigate the effect of energy price changes. In the case of the Cameron Shale facility it has been reported that there will be tolling agreements in place.

Have key risks been sufficiently mitigated?

As with all business sectors the oil and gas sector faces significant market, construction related, operational and financial risks. The predictability of cash flow is crucial in structuring a Project Finance. In terms of market risk there are divided views. For optimists if the recovery from the global credit crisis gains momentum perhaps this will result in stable or rising energy prices. By contrast will the shale gas revolution result in a sharp fall in global gas prices, not just in the US? Perhaps also the impetus to increase Renewable Energy resources will result in declining oil and gas prices?

In addition to market risks past experience has demonstrated the need to mitigate country and political, construction, operational and financial risk exposures. Projects in countries with perceived high political risks and budgets that rely substantially on “pre market downturn oil and gas prices” are vulnerable to changes in the attitudes of providers of both debt and equity capital. Continuity of energy supply on the contracted and projected basis has and continues to be a major consideration in the overall risk assessment. Even with projects with a strong contractual framework and purchase contracts country and political risks are important elements in the attitudes of providers of capital.

The focus has been on energy prices but don’t forget interest and currency rates

Financial risks have been referred to in the section above on key risk mitigation. In this context, since the significant downturn in oil and gas prices in 2014, there have been substantial changes in exchange rates, with the US$ for example appreciating sharply against the €.

Interest rates are also moving on divergent paths. Economic data in the US is giving rise to more speculation that US$ interest rates will rise. By contrast in the Eurozone interest rates for strong credit counterparties are at very low levels…with negative short term rates in some instances…. and the outlook is uncertain as the European Central Bank initiates its recent quantitative easing programme.

The above factors make it essential that the impact of interest and currency exposures , whether negative or positive, are carefully considered in evaluating both existing and projected energy projects and companies in the energy sector.

Past experience however shows that even in challenging market conditions major energy projects can attract both debt and equity finance.

In the early 1990s the Qatari energy industry was at an early stage of development and oil prices were in the region of US$15/ barrel or even lower. However Project Finance for some of the early LNG and other energy projects in Qatar with major sponsors, strong mitigation of construction and operating risks and long term offtake agreements provided a basis for medium – long term funding and also a financing structure that was able to withstand changes in the financial markets following the Asian and Russian “crises” of the late 1990s.

Project Finance has been available, although on a more selective basis, post credit crisis.

Fast forward to the past few years and the US shale gas revolution. Cheniere was able to arrange debt and equity finance for the Sabine Pass Liquefaction US LNG export project with debt financing from both the banking and Capital Markets. How the market changed is well illustrated by the fact that within the last seven or so years Cheniere was involved in the financing of receiving and regasification terminals for the import of gas into the US…a project that utilised Project Finance on the basis of long term Terminal Use agreements. Subsequent to the Sabine Pass Liquefaction US LNG project Cheniere announced in December 2014 has that it has engaged 18 financial institutions to act as Joint Lead Arrangers (“Arrangers”) to assist in the structuring and arranging of up to US$11.5 billion of debt facilities. The proceeds will be used to pay for the costs of development and construction of the LNG export facility and related pipeline being developed near Corpus Christi, Texas and for general business purposes. As for the Sabine Pass transaction financing is reportedly based on the availability of a specified amount of contractual purchase agreements. The debt facilities are intended to be supplemented by issuance of Convertible Notes.

Effective financial structuring is essential

The ongoing impact of the global financial crisis also continues to create financing challenges. Post credit crisis there has been a “flight to quality” in terms of the underlying project viability, the quality of the sponsors, a more selective approach towards country and political risks and the need for strong financial metrics.

Conclusions

An underlying principle of Project Finance is that risk should be allocated to the parties to the project that are best able to manage those risks. Market downturns result in greater selectivity in choice of credit counterparties and tighter credit conditions. With effective allocation and mitigation of key risks – whether country /political, market, construction, operational or finance related – oil and gas projects that are financially viable at current market prices, with strong sponsors and effective mitigation of key risks, Project Finance is a financing method that can produce a solution that meets project stakeholders’ objectives and may become a more viable source of finance for weaker corporate credit counterparties as financial institutions become more selective in projects and sponsors they are willing to consider.

Leave A Comment