Infrastructure finance needs are huge but can they be met by a mixture of Public and Private Finance sources? In this article some key issues are identified and questions raised about areas to be resolved.

The challenge of financing infrastructure….huge financing needs.

The estimated need for Global Infrastructure over 2013-2030 period has been estimated in one report at US$57 trillion in 2010 real terms.

Estimates of what is achievable in terms of meeting Infrastructure requirements may be significantly overestimated and unachievable when considered in the context of statistics on GDP. It is however commonly accepted that there is a substantial Infrastructure Finance Gap.

Financing from Government budgets will, as in the past, be a source of finance, but where will the balance be financed?

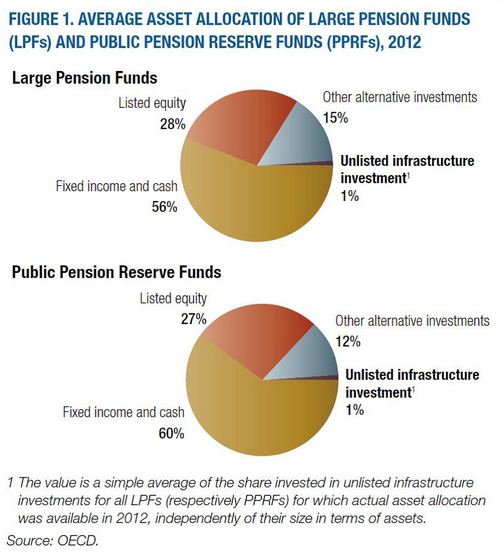

An OECD report – Institutional Investors and Long – term investment, May 2014 – estimated Total Assets of Institutional Investors at US$81.2 trillion in 2012. The same OECD report estimated that at the end of 2012 that the average asset allocation of Large Pension Funds and Public Pension Reserve Funds was about 0.9% for the Investment Funds Surveyed.

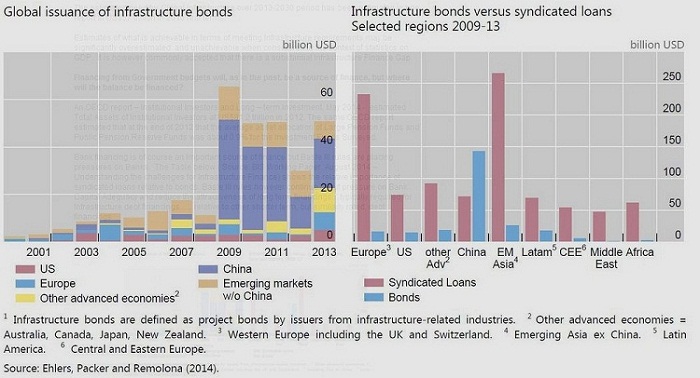

Bank financing is of course an important source of project and infrastructure finance but Basle III rules are placing pressures on Banks. The Table below ( Source: BIS Working Paper, August 2014 – Understanding the challenges for Infrastructure Finance) shows the relative importance of syndicated loans relative to bonds. Basle III rules however continue to put pressure on Bank Capital Adequacy and reduce the attractiveness of long term financings…typically required for Infrastructure debt financings….. relative to other shorter term, but similarly rated, debt financings.

The current macroeconomic and financial environment places constraints on the availability of finance

Approaches to the financing of infrastructure vary according to political ideologies but in many countries where there are significant infrastructure needs there are also powerful constraints on how infrastructure can be financed, such as

1. The build up of sovereign and personal sector debt in recent decades

2. Prospect for weak growth in many mature economies

3. Slowing growth in many Developing Economies

4. Recent declines in commodity prices.

This will have negative implications for economies that previously benefitted from the commodity price boom

5. Ongoing deleveraging of the banking sector

The most likely scenario is that many planned / announced infrastructure projects will be either delayed or not take place in the foreseeable future

Given the factors mentioned above the most likely scenario is that governments will have to scale back planned infrastructure projects and continue to work with the private sector in developing mixed Public /Private sector funding methods to meet infrastructure development needs.

What are the implications for Governments of having to cut back on planned infrastructure projects?

Governments will want to stimulate economic activity through infrastructure spending but economic conditions are likely to place major constraints on what can be achieved.

The period from the beginning of the 1990s to the onset of the credit crisis can be considered as extraordinary: The volume and speed at which infrastructure projects in a wide range of sectors such as transport, telecommunications and power were developed in the last 30 years is astonishing. Current economic conditions are likely to result in a much more selective approach to what is financeable in the near future, and

Governments will have to examine viability of planned infrastructure investments carefully to see if they can be justified in terms of ability to generate incremental revenues …for example ports and airports….or to minimise potential needs for public subsidies.

Governments will need to further develop existing mechanisms of PPP/ mixed Public/Private sector funding for infrastructure projects that balance the needs of government to create economic and social benefits with the requirements of private sector providers of capital for well structured financings with appropriate risk /reward

How are Private Sector financiers likely to respond to the huge demand for financing infrastructure projects?

Positively but selectively.

There are a number of reasons to believe that Infrastructure Finance will be appealing to the Private Sector, such as

• Low default rates on PPP/ PFI Project Finance transactions.

In a Moody’s report entitled Default and Recovery Rates for Project Finance Bank Loans – 1983 – 2012, one conclusion is that PPP/ PFI based Project Finance transactions have lower levels of default and higher recovery rates than Project Finance transactions as a whole. Although the report states that Default Rates for projects in the infrastructure sector have risen since the previous Moody’s study they remain better than the study average

• Long maturity profiles well suited to institutional investors

• Infrastructure Projects are often focussed on services that meet fundamental user needs.

In the current environment spending by governments is likely to be focussed on essential services, particularly those that could be income generating such as airports and ports.

• Relatively attractive returns compared to other Asset classes.

As with all statistics there will be different conclusions based on the composition of the data. In general however results from various studies indicates a good risk / reward profile from Infrastructure Investments in both the pre and post credit crisis years of the 21st century

• Major Institutional Investors have very low asset allocations to Infrastructure.

This is likely to reflect lack of opportunities rather than a lack of interest in the Infrastructure Asset Class

Source for charts above: OECD report, May 2014 – Institutional Investors and Long – term investment

Lessons from the past….implications for the future

Based on past experience key areas that will need to be addressed on infrastructure finance include

Construction Risk and cost overruns: The Moody’s Project Finance Default study, referred to previously not surprisingly, concludes that recovery rates are lower for projects that experience problems during the construction period. Projects like Eurotunnel illustrate the importance of strong credit protections during the construction period.

In the book Megaprojects and Risk: An Anatomy of Ambition Paperback – March 10, 2003,authored by Bent Flyberg,Nils Bruzelius,Werner Rothengatter, there are several examples of mega infrastructure projects with huge cost overuns.Prominent examples include the London Undergroiund Concessions,Eurotunnel and several metros systems.

The tendency for large cost overruns on “mega projects” is likely to mean that private sector providers of capital will be cautious in financing such projects.

Market risk: In the transport sector there are several high profile projects that have traffic volumes substantially below forecasts.

Political risk: There are many example of utility projects where there were restructurings as tariffs became financially and / or politically unacceptable.

Risk / Reward balance: For PPP projects a rationale for the projects is that potentially higher finance costs in the Private sector can be justified by transfer of risks to the Private Sector as well as efficiency improvements. In some cases the rewards for the Private Sector on Social Infrastructure projects have been far higher than originally expected. Although this has been subsequently been partly addressed by sharing gains on refinancings, structuring of future PPP Infrastructure projects will need to take into account a balance between risk and reward and the objectives of the Public and Private sectors.

Long term nature of Infrastructure Concessions vs financial and operational flexibility for users: Whilst a predictable cash flow for debt and equity investors is attractive to the private sector, this needs to be balanced against the need for flexibility for users of the Infrastructure and protection against substantial breakage / Termination costs.

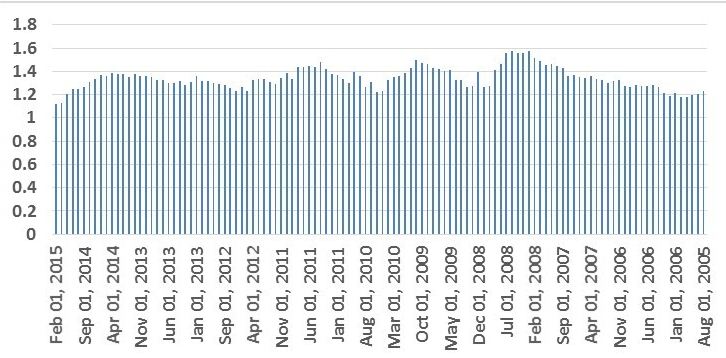

Foreign exchange risk: In some cases the size of the local Capital Markets limits the possibility of local currency financing and there is an ongoing need for Development Finance Institutions to facilitate growth of local Capital Markets. Past experience has shown in Developing Economies, in particular, that foreign currency exposures can and do have a material adverse effect on project viability. Foreign exchange risk is of course not limited to Developing Economies…for example, as shown below, the US$ appreciated sharply against the € in the second half of 2014.

Source: http://www.investing.com/currencies/eur-usd-historical-data

Interest rates

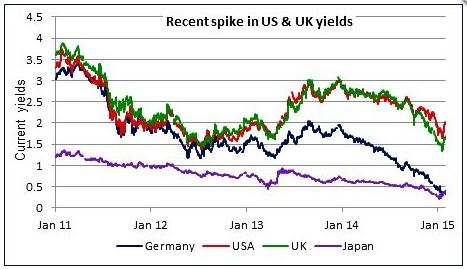

Current interest rates in the US, Western Europe and Japan are at extraordinary low levels, so projects without interest rate protection are vulnerable to any increases

Source: Money Week

By contrast, financings with interest rates hedged at above current market levels may face substantial unwinding costs if financings are terminated.

Commodity prices

For Power and Natural Resource related projects energy and commodity prices clearly have a major impact on project viability.

Commodity prices are also a major influence on national budgets, particularly in economies with high dependency on commodity prices. Particularly in Infrastructure transactions that rely on contractual payments from Public Sector entities the impact of the sharp fall in oil and gas process since mid 2014 as well as lower prices for other commodities on the ability and willingness of governments to meet contractual commitments needs to be carefully evaluated.

Counterparty risk …don’t forget reliance on ongoing subsidies too

A large number of Infrastructure projects have been for social infrastructure (schools and hospitals) with availability payments from Public Sector Entities. In sectors such as Renewable Energy and Transport, public subsidies for consumers are usual. Moreover Termination Payments, dependent on a Public Sector Entity, provides credit support for Concessions granted to Private Sector operators. The continuation of, and basis of payment for, subsidies and /or willingness of Public Sector Entities to meet contractual obligations is a key credit risk consideration.

Opportunities for new/ expanded financing techniques

Among areas that could offer potential are

Securitisation and financings for pools of transactions

Prior to the credit crisis there were a few securitisations of UK PFI debt financings. Securitisation offers the potential to expand the range of financing options. Standardisation of key contractual provisions will facilitate securitisation. In Emerging Markets Development Finance Institutions have the potential to assist in this process.

As Infrastructure financings are often supported by contractual payments from Public Sector Entities, rather than financing projects on an individual basis , financing of pools of projects may be a more efficient and flexible approach particularly for small – mid sized projects.

Hybrid financings…convertibles

In structuring a Project Finance a key consideration is to balance the risk / reward profile of the Public Sector and providers of capital in the private sector. Governments will also want the private sector to share demand risks where feasible. For transactions where there is market risk (as opposed to payments based only on availability and operating performance). Convertible bonds provide the scope to balance risk and reward in the financing of infrastructure projects exposed to market risks.

Credit enhancement……partial risk guarantees

Prior to the credit crisis credit enhancement from a monoline insurer was often used to credit enhance bond issues. The problems faced by several monoline insurers following the credit crisis has limited the scope for currently using that approach.

Initiatives like the European Investment Bank’s Project Bond Credit Enhancement programme provide the opportunity for increasing access to the Capital Markets to finance Infrastructure projects, as do Government guarantees.

For debt providers, default risk and recoveries in the event of Default are of course the financial risk that debt providers are exposed to. In the past Credit Enhancement has primarily been on the basis of 100% coverage or close to it. Each Infrastructure project has its own characteristics, but in some cases a partial risk guarantees may be all that is needed for an Infrastructure project to achieve a solid investment grade rating. Partial risk guarantees offer the scope for being able to support a larger number of financings.

Partial risk sharing for Infrastructure financings

In longer term PPP projects an objective of governments is to shift risk to the private sector and to estimate the potential benefit in terms of Value for Money comparisons between Public and Private Sector financings. This does however involve, where construction risk is a consideration, sacrificing potential returns on projects.

Partial risk sharing of selected risks may therefore be an option for the Public Sector in some cases, as well as retaining risks on some projects at early stages of the development process and subsequently refinancing infrastructure projects.

Conclusions

Requirements for Infrastructure spending may be significantly overstated but based on past levels of asset allocation by Private Sector Fund Institutional Investors and continuing pressures on banks, combined with the current low levels of forecast economic growth it seems likely that there will be significant constraints on financing the forecast level of Infrastructure requirements.

Should economic growth continue to be slow and interest rates low financing Infrastructure projects supported by long term contractual cash flows may however be an attractive proposition for Institutional Investors and help to reduce the infrastructure financing gap.

Leave A Comment