1. Where are we now and what has been the experience since the onset of the credit crisis?

It is now over 7 years since the collapse of Northern Rock and the onset of the sub prime crisis which was a major contributor to the global financial crisis. With hindsight it appears that the global credit crisis has been not just about a cyclical downturn in real estate markets but has also been heavily influenced by a liquidity crisis, compounded by regulatory action designed to strengthen the financial system.

The length of time since the credit crisis and its ongoing effects however show that the post 2007 credit crisis is not a typical business cycle but marked the onset of a series of structural changes which will have profound affects on investment allocation decisions. What are the implications for Real Estate Commercial Finance and Investment?

At the time of writing (April 2015) investors in Commercial Real Estate have reasons to be pleased with returns from direct Real Estate Investments over 1, 5 and 10 year periods in some of the mature economies performing well relative to inflation when measured in local currencies.

Similarly, in some locations, investors in residential property may be thinking that residential property in a number of markets is “as safe as houses” as shown in the following graph (Source: http://www.imf.org/external/research/housing/)

2. Has recent strong Commercial Real Estate performance simply been a reflection of a typical economic cycle? If so, what’s next?

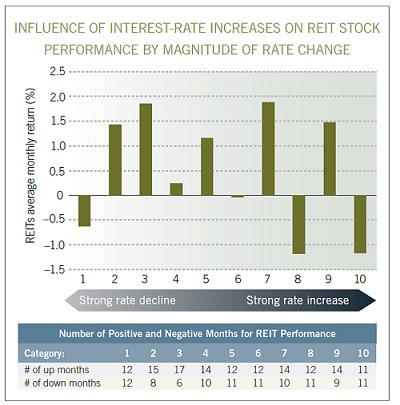

Past experience has suggested that real estate performance is very sensitive to interest rates. If so, what would be the affect of higher interest rates reflecting higher growth, or continued low inflation and low growth?

As with all investment and financing choices there is no “one size fits all” but there are some major themes that will influence the financial landscape with implications for Real Estate:

i. The World Economic Outlook

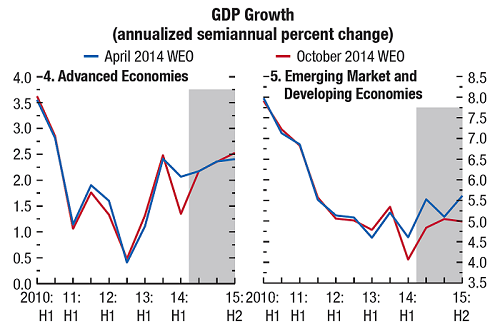

As will be seen from the following graphs (Source: IMF World Economic Outlook, October 2014) there has been an improvement in the overall economic environment but the position in Advanced and Developing Economies is quite different.

Even within the Advanced and Developing Economies there are marked differences. The US has been performing better than the Eurozone . Within Dev eloping Economies some countries will be adversely affected by the recent declines in oil prices and regional political instability.

eloping Economies some countries will be adversely affected by the recent declines in oil prices and regional political instability.

ii. The overhang of debt

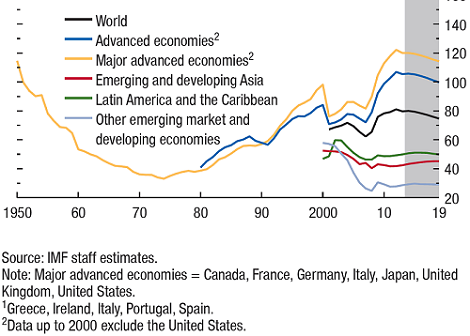

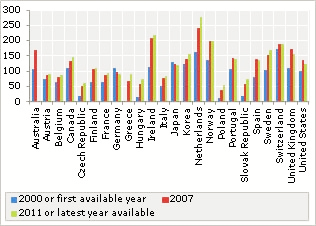

Many major economies are struggling to reduce the level of indebtedness, as shown in the table below on Public Gross Debt as a percentage of GDP

As also shown below (Source: OECD Financial Statistics) Household Debt as a percentage of Gross Disposable Income was rising substantially before the credit crisis. At current levels of economic growth households in many markets will find it difficult to reduce their debt

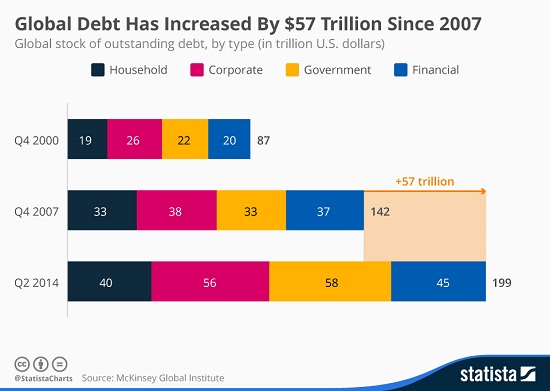

Source: http://www.statista.com/chart/3215/global-debt/

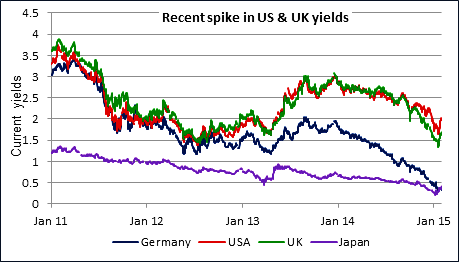

iii. Low interest rates

Even where economic growth is improving bond yields are very low as shown in the chart below (Source: Money Week)

iv. Technology is continuing to change how we work and how we shop

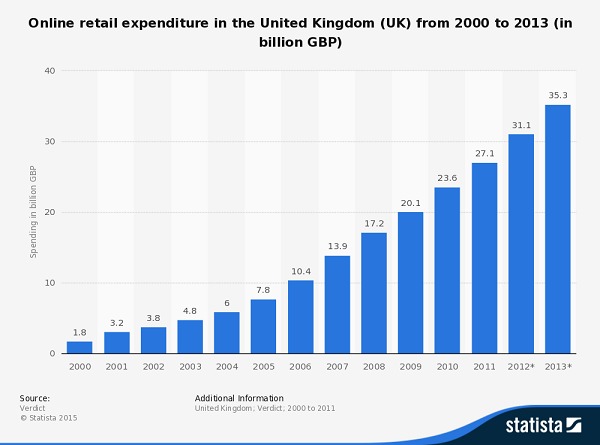

Hot desking, improved telecommunications technology and on line retailing are now part of the way that we work and shop with implications for occupational demand for office and retail real estate

Source: http://www.statista.com/statistics/283165/online-retail-expenditure-in-the-united-kingdom-uk/

By contrast with the high rates of growth in on line shopping, there is a high vacancy rate in retail premises in the UK. According to a report on the BBC News website “…..The Local Data Company, which monitors 3,000 town and shopping centres and retail parks, said one in five shops in the North was now empty, compared with one in 10 in the South”……

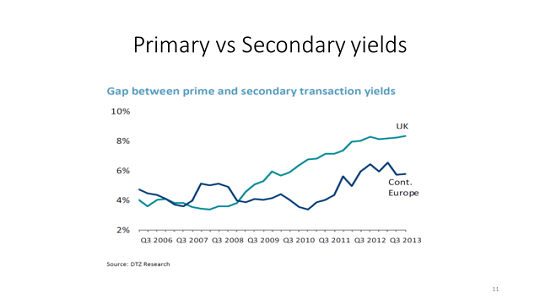

v. Urban populations are growing and there is a polarisation between the value of Prime and Secondary locations in terms of commercial real estate

vi. People move to where they believe there are reasonable chances of employment, especially in weak economic conditions

Low growth areas will continue to have high levels of structural unemployment in the absence of change. This will depress Real Estate values in those areas but also result in pressure on well established locations which will be an underpinning of Real Estate values in those areas.

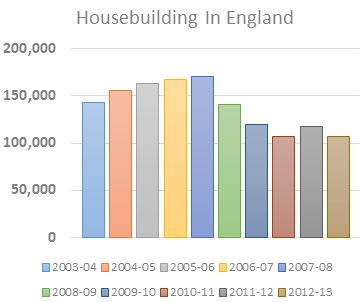

In England it is estimated by the House Builders Federation that new housebuilding will need to be in region of 220,000 units per year. This is substantially higher than has been the case in recent years as per the graph below (Source: House Builders Federation).

3. Consequences of major themes for Investment Markets and Real Estate and investment approaches

3. Consequences of major themes for Investment Markets and Real Estate and investment approaches

The historically low levels of interest rates combined with low inflation, as well as structural changes in Real Estate markets have profound affects for investment, both in terms of implications for risk and return from an investor standpoint as well as investment styles and how targeted returns are achieved.

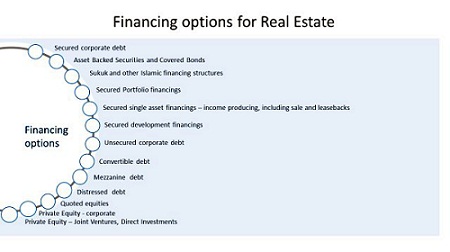

In terms of risk and return Real Estate offers a broad spectrum of opportunities. As a generalisation the following illustrates the range of financing options.

At different stages of the Real Estate cycle the most appropriate risk / reward profile in terms of financing instrument, market liquidity, and the general risk profile of providers of capital the approach to risk will need to be evaluated. For example in the immediate aftermath of the credit crisis process of some RMBS and CMBS transactions may have potentially been attractive notwithstanding the heightened levels of risk because market prices were taking into account lack of liquidity as well as the underlying credit risks.

- Is a traditional buy and hold approach to Real Estate Investment still viable in the current economic environment?

Particularly in the retail investment market the “traditional” investment management business model of relatively high fees and “buying and holding investments” could only be sustainable when absolute levels of return arising from a buy and hold strategy were expected to be significantly higher than fees plus an acceptable level of projected returns. The buy and hold investment style was also more prevalent in markets like the UK where there were long term occupational leases which provided continuity of cash flow and where the major investors were institutional financial investors . Where rental yields are currently higher than on other assets classes, Real Estate Investments have to take into account factors like rent renewals and reviews and the impact of any changes in investment yields.

- What other approaches have been developing to meet the challenges of a low interest rate and low inflation environment?

The decline of the “buy and hold “investment model is therefore giving way to various alternative approaches, some of which are

i. Private Equity and Debt Funds with shorter term time horizons who seek to achieve returns mostly by a combination of general compression of investment yields through the economic cycle, combined with some aspects of value added.

Following the downturn in the financial markets after the “technology crash” in the early years of the Current Millennium, a low interest rate environment encouraged higher leveraged investors to enter into the market. Financial engineering made leveraged investors more aggressive in pricing Real Estate investments relative to unleveraged investors. Returns to Private Equity Real Estate Investors were a function of anticipated benefits from decreasing Real Estate yields combined with expected rental growth through a combination of more active management of Real Estate holdings and anticipated improvements in the economic environment.

If trends follow past economic cycles the scope for returns from yield compression in Prime Real Estate Investments may however now be becoming more limited even where yields are higher than on comparable investments.

ii. Trading of listed investments – direct vs indirect investment – a Hedge Fund strategy

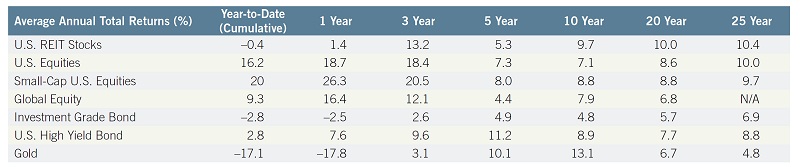

A consideration in holding Real Estate Investments in a diversified portfolio is the relative lack of liquidity in holding direct real estate. This however has to be seen in the context of an increasing number of REIT in the US and REIT enabling legislation in many other countries.

Moreover, as the table below shows REIT performance has historically performed well in the US relative to other asset classes

Source: Fidelity report, September 2013 –REIT Stocks: An underutilized Portfolio Diversifier (https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/REIT%20Stocks%20-%20An%20Underutilized%20Portfolio%20Diversifier_Fidelity.pdf)

Even if rates continue to be generally low markets may however be volatile and this can create opportunities for “Absolute Returns” types of investors such as Hedge Funds.

iii. Active management of Real Estate – a Real Estate Company strategy

Historically, especially for private individuals and Institutional Investors, Direct Commercial Real Estate investments have typically been passively managed, reflecting

- lower liquidity than quoted bonds or equities of comparable size;

- predictable cash flows in cases where there are longer term occupational leases

- occupational leases which are structured so that tenants pay all outgoings dependent on the market norms

As mentioned previously this “buy and hold” approach may not be sustainable if there is a protracted period of low inflation and low interest rates.

Moreover, there has been a general shift towards shorter term occupational leases and turnover related occupational leases in shopping malls, both of which require a more active approach towards management as a basis for achieving desired investment returns.

The establishment of REIT legislation in an increasing number of countries has provided more opportunities for Real Estate Investors. However the restrictions on REIT activities and leverage and dividend distribution rules limits the scope for active management of Real Estate, such as the degree of development activities, as a basis for potentially enhancing returns.

iv. Distressed debt investment and active portfolio management

The Global Financial Crisis placed severe pressure on bank loan portfolios. In the area of Commercial Real Estate this was compounded by the vast volume of maturing debt in the years following the onset of the credit crisis.

The vast amount of distressed debt has therefore created a vastly expanded market for non bank investors to acquire real estate related assets.

v. Changes of use of properties

The current economic crisis, technology, demographics and other factors have had and will have affects on valuation of Real Estate.

In some cases a change of use may have a dramatic impact on values. Agricultural land values in the past often increased dramatically when receiving planning consent as business parks, hotels in some locations became more valuable as apartments and in the current environment converting Commercial Real Estate to residential has become viable in some locations.

vi.New and / or expanded Real Estate Asset classes

As investment returns become more difficult to achieve in some sectors of the Real Estate Market, investors, as in any other market sector, will try to find other investment opportunities.

The institutional Investor market has historically concentrated on large scale commercial buildings and the Prime or close to prime market. This however excludes other areas of the real estate market which are potentially vast and which are being driven by major trends such as

Demographics

With an ageing population there is increasing demand for residential care homes.

Education

In locations with well established Universities there is strong demand for affordable housing for students.

Affordable Housing

Both in Developed and Developing countries “housing affordability” is a growing concern. This typically reflects basic supply and demand issues. Part of the supply / demand imbalance can be addressed by using Real Estate that is surplus to requirements in its existing form.

5. Conclusions or just more questions?

Interest rates are at current low levels and as the chart below ( Source: Fidelity Investments report, September 2013, REIT Stocks: An Underutilized Portfolio Diversifier) shows for the time period illustrated that interest rates have been a key influence on US REIT performance.

2014 has also been a period where there has been heavy activity in the Commercial Real Estate activities with some very sizeable transactions which has contributed to strong performance of Commercial Real Estate in some markets like the UK.

History has illustrated that there will be market cycles. What is not clear is how long the current low interest rate and low inflation environment in major Developed Economies will continue.

As shown above there is much evidence to suggest that investors are faced with structural changes rather than a typical economic cycle. Anticipated low levels of economic growth in many major markets, combined with persistently high levels of debt, may cause may investors to increase their asset allocations to Real Assets, but the scope for high returns from passive medium to long term “buy and hold” strategy may be limited. Traditional Commercial Real Estate Investment strategies may therefore have to change, but there are a variety of approaches to and increased opportunities for Real Estate Investment to meet the range of risk and return expectations.

Leave A Comment